Resources to help you along your property journey.

We deeply appreciate the trust you place in us and are committed to handling every detail with care and professionalism.

Upsizing Your Home? How to Know When It’s Time for More Space

Feeling cramped after summer? From growing families to lifestyle changes, here are the key signs it may be time to upsize your home and how to plan your next move with confidence. The Summer Reality Check For many homeowners, summer is when it becomes clear their home no longer fits their lifestyle. Between Christmas, New…

Lebanese-Spiced Chicken & Spinach Soup with Rice

This warming, flavour-packed soup features golden Lebanese-spiced chicken thighs served over jasmine rice, finished with a vibrant spinach broth, pickled red onion, and fresh jalapeño. Comforting, fresh, and perfect for any season. Ingredients Method 1. Season the chicken In a bowl, combine the Lebanese 7-spice with a good pinch of salt, black pepper, and a…

Flipping vs Renting: Which Property Investment Strategy Is Right for You?

Two Popular Paths Into Property Investment If one of your New Year goals is to start investing in property, you’ve likely encountered a familiar question:Should you renovate and flip for a quicker profit, or buy and hold a rental for long-term income? Both strategies can work well, but they suit different personalities, timelines, and risk…

Pistachio and Blackberry Olive Oil Cake

Soft, nutty pistachio sponge made with olive oil, layered with blackberry jam and finished with a lightly salted blackberry and thyme buttercream. Elegant, balanced, and perfect for summer entertaining or special occasions. Makes one two-layer 15–18 cm cakePrep: 20 minutesBake: 30 minutesCooling & resting: 2 hoursTotal: approx. 2 hours 50 minutes Ingredients Pistachio Olive Oil…

Buyers Watch for Positive Signs to Spark a 2026 Property Revival

As 2026 begins, buyers are watching for economic confidence to return. With interest rates lower and demand building, early movers may benefit from the next phase of the NZ property market. A Steady Market Sets the Scene for 2026 As we move into 2026, New Zealanders can reflect on a property market that remained resilient…

Property Prices Strengthen as Rate Cuts Boost Affordability

Falling interest rates are improving affordability and driving price growth across parts of New Zealand, with South Island markets leading the recovery. Lower Interest Rates Lifting Market Confidence The New Zealand property market is beginning to show clear signs of stabilisation and recovery, following another 0.25% reduction in the Official Cash Rate (OCR). The cut,…

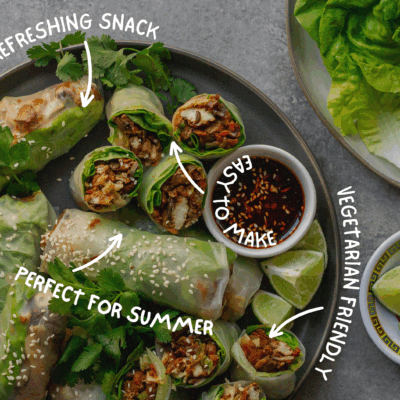

Fresh Veggie Summer Rolls with Savoury Tofu & Mushroom Filling

These vibrant rice paper rolls are packed with a flavourful mix of tofu, mushrooms, and crunchy veg, all tossed in a bold, umami-rich sauce. They’re fresh, light, and perfect for warm-weather snacking, shared platters, or an easy weeknight dinner. This recipe makes 15 rolls! Ingredients Seasoning Sauce Filling To Assemble Method 1. Make the sauce…

Record Participation From First-Home Buyers

First-home buyers are entering the New Zealand property market in record numbers, driven by falling interest rates and improved affordability. According to the latest Cotality and Westpac NZ “First Home Buyer” report, first-time purchasers now account for 27.7% of all residential sales—the highest level ever recorded in New Zealand. This surpasses the previous peak of…

Rate Cut and Loan Changes Set to Boost New Zealand Property Market

The recent 0.5% OCR cut and updated LVR rules are expected to improve buyer access and confidence, sparking activity in the New Zealand property market. OCR Reduction Sparks Optimism for Property Buyers The Reserve Bank of New Zealand’s recent 0.5% cut to the Official Cash Rate (OCR) has created renewed optimism for the property market.…

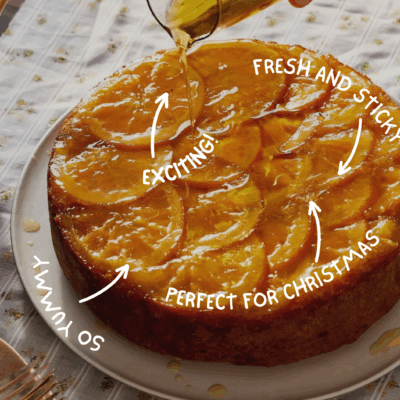

Upside-Down Orange & Cardamom Olive Oil Cake

Makes: one 25cm round cake or 23cm square cakePrep time: 1 hour 10 minutesCook time: 1 hourTotal time: 2 hours 10 minutes This stunning citrus cake features tender, syrup-soaked oranges layered over a light and fragrant olive oil sponge. With hints of cardamom and orange zest throughout, it’s a showstopper that only gets better as…

Investors Are Back: Why Now Could Be the Smartest Time to Buy Property in New Zealand

With investors making up 25% of all buyers and interest rates dropping, now may be the perfect time to secure a property before prices rebound. Explore the latest NZ real estate insights. A Turning Point in the Property Market After a period of hesitation, signs suggest that confidence is returning to the New Zealand property…

Five Top Selling Tips as Westpac Forecasts 5.4% Property Price Growth for 2026

Westpac NZ predicts 5.4% house price growth next year. Discover five expert tips to maximise your sale and make the most of the coming market upswing. Westpac NZ has released a new housing report predicting a 5.4% lift in property prices next year, signalling a potential turning point for the New Zealand real estate market.…

Let’s discuss your home selling strategy.

By choosing us, you’ll benefit from our expertise and commitment, ensuring you feel confident and valued throughout the entire process.